In my first article in this evolving series, I wrote about six oil companies lying to the public to convince them that they had a ‘magic bullet’ that would allow business as usual even in the Climate Emergency—and how the federal government’s new truth in advertising regulations shut down their campaign. In the second one, I showed that while there are substantial amounts of money brought into the Canadian economy by oil, there are also real costs that the taxpayers either already pay or are at risk of paying in order to prop up the Canadian oil industry. In the third one (confusingly labeled ‘second’—I know, but I can’t change the title retroactively), I discussed the cost of production, the future of oil, and, the way the tar sands have affected Canada’s Total Factor Productivity (TFP) score. In this, hopefully my last article on this subject, I thought I’d bring in a concept that I rarely see discussed but which I think citizens should be aware of: the resource curse.

The Resource Curse

Economists and political scientists have noticed for a long time that something seems to happen to societies blessed with any sort of natural abundance. They call this ‘the resource curse’:

Subsoil assets are property of the state in almost all countries except the United States. Thus, to navigate the multiple stages in the use of natural resources successfully, governments in resource-rich countries need to be well-intentioned, far-sighted, and highly capable. Yet many resource-rich economies have weak governance that can be further undermined by the political forces that are unleashed with the prospect of resource wealth.

(Using Natural Resources for Development: Why Has It Proven So Difficult?', Anthony J. Venables. Journal of Economic Perspectives—Volume 30, Number 1—Winter 2016—Pages 161–184)

Is Canada one of those resource-rich nations that is prone to the resource curse?

The IMF classifies 51 countries, home to 1.4 billion people, as “resource-rich.” This classification is based on a country deriving at least 20 percent of exports or 20 percent of fiscal revenue from nonrenewable natural resources (based on 2006–2010 averages as explained in IMF 2012b).

(Venables, Using Natural Resources for Development)

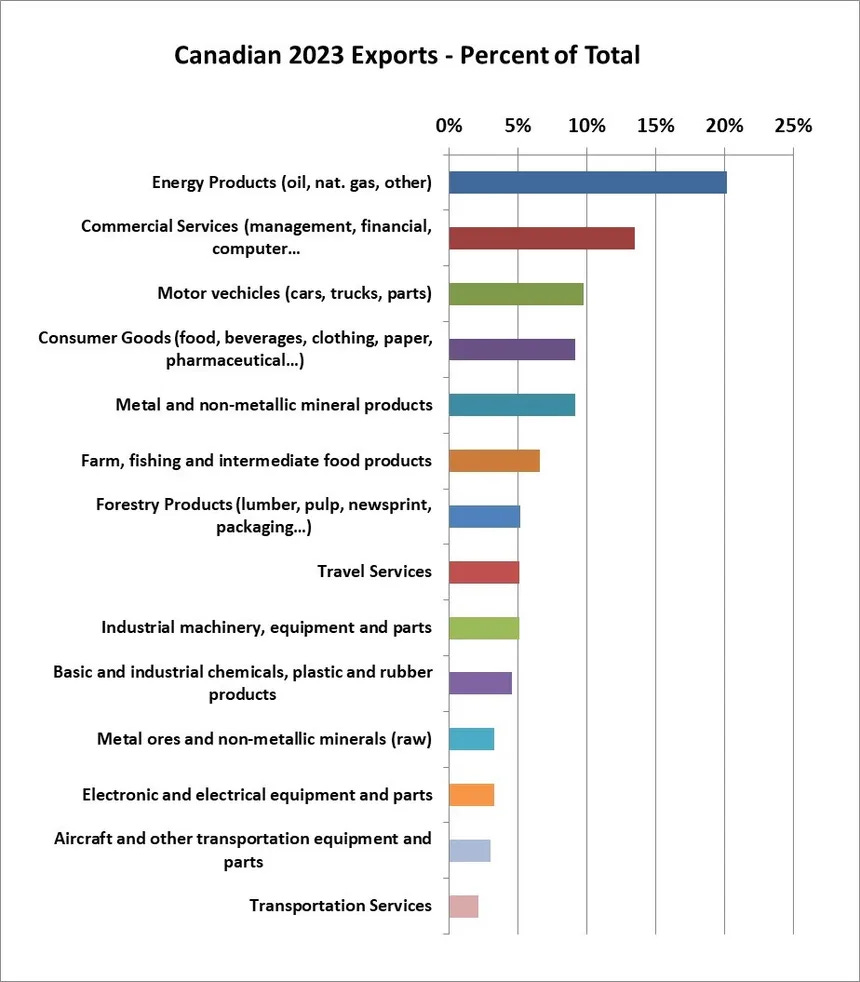

Let’s look at what Canada exports:

As you can see, oil alone puts us in the group of nations that are dependent on exporting natural resources. If you add in minerals, forestry, and, ores in 2023 something like 38% of our exports consisted of natural resources. This certainly puts us in the zone where we should be concerned about the resource curse.

So what are the mechanics of the resource curse?

What comes to mind first would be kleptocracies that uses the money raised by selling the nation’s natural resources to fund an oppressive government. Putin’s Russia comes to mind, but there are other examples too—like the absolutist monarchy of Saudi Arabia.

An even worse situation exists in the Congo, where various militias are able to make money off mines selling valuable rare minerals to fund their never-ending wars with one another. Here’s a map of that nation that shows ‘artisanal mines’ (now there’s a euphemism!) that are controlled by local and foreign military groups that use them as a source of funds.

Surely Canada doesn’t suffer from these sort of problems—or does it?

Consider an article published in the Globe and Mail on August 23, 2024 by Bob Weber titled Municipalities say Alberta oilpatch policies harming tax base, public interest. According to it, the Albertan government has decided to yank significant revenues away from municipalities in order to help an oil industry that they feel has been damaged by too much taxation and environmental regulation.

Alberta’s United Conservative government is trying to increase production from the province’s declining conventional oil and gas fields at the expense of local tax bases, environmental oversight and the public interest, says the group representing rural municipalities.

Rural Municipalities of Alberta held a town hall meeting earlier this month to discuss the impacts of enacted and upcoming policy changes that they fear will cost them hundreds of millions of tax dollars, weaken rules over failing wells and hamstring regulatory authority.

“Does [industry] need to be stimulated on the backs of rural Albertans?” asked association president Paul McLauchlin. “That’s the choice that’s being made.”

What sort of changes did the Alberta provincial government institute that affected municipalities?

it allowed fossil fuel companies that owned properties that owed municipalities back taxes the ability to transfer these properties to other companies—who could then declare bankruptcy so as to avoid ever paying those back taxes

the provincial government suggested to municipal governments that they were just spending too much money and should cut back their spending

it instituted a three year tax holiday for municipalities so they can’t levy taxes on new oil and gas project immediately after they are built

the provincial energy regulator’s mandate was changed such that they are forbidden to consider anything but technical issues about the infrastructure—no environmental or social considerations will be allowed

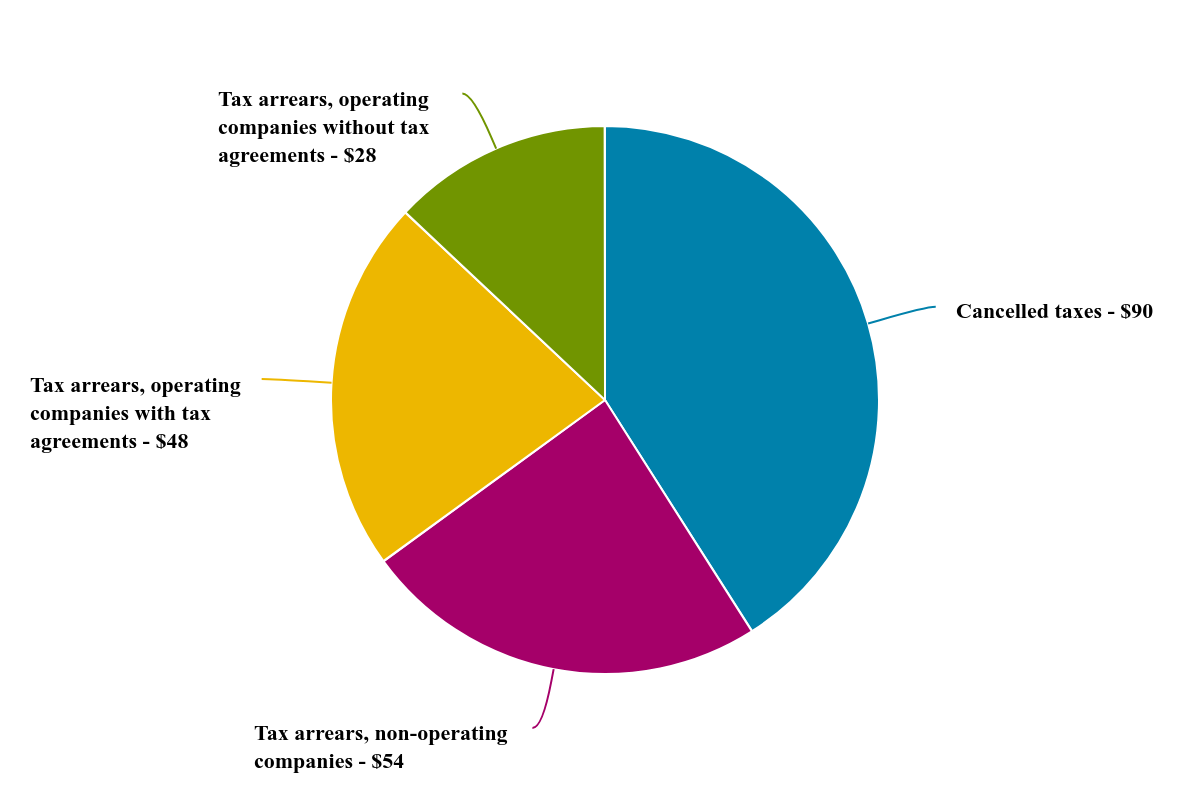

There appears to be a problem with oil companies deciding they no longer can afford/want to pay municipal taxes. See the following pie chart from an 2022 official government of Alberta website (numbers are in millions of dollars Canadian) that describes the arrears in rural municipal taxes paid by oil and gas companies:

I generally try to convert these sorts of numbers to percentages, but in this case I strongly suspect that these problems are not evenly spread across the province. Some rural municipal governments will be strongly hit by this problem—others not so much.

Here’s a 2020 Rural Municipalities of Alberta (RMA) press release that supports my intuition:

Nisku, AB, August 25, 2020 – The Rural Municipalities of Alberta (RMA) continues to be extremely concerned with the changes to the assessment model for oil and gas properties that are currently being considered by the Government of Alberta. The proposed changes could reduce total rural municipal revenues by as much as $291 million in the first year of implementation, with some rural municipalities losing over 30% of their revenues. RMA is proud of Alberta’s energy sector and the role our members play in providing access to natural resources and wants to work with the province and industry on solutions to support industry without decimating rural municipalities.

and

“Alberta’s rural municipalities have service and infrastructure responsibilities matched nowhere in Canada. RMA members provide services to huge areas of the province and most have a very small residential tax base. Rural municipalities are the unseen supporters of Alberta’s economy by managing the roads and bridges that provide access to Alberta’s natural resources. Accusing Alberta’s rural municipalities of poor financial management using per capita measures is not only inaccurate, it reflects a complete lack of recognition for their role in the province’s past success and future growth.” – Al Kemmere, RMA President

It seems from the above that some rural areas are more dependent on money from oil and gas infrastructure than others—and some of then probably have a lot more to pay for than just fixing pot-holes in the downtown.

There’s another thing to consider. Most readers will be aware of the giant savings fund that Norway created to save money from it’s windfall oil.

Now let’s compare this to Alberta’s Heritage Savings Trust Fund:

According to a government of Alberta website, the Gross Domestic Product of Alberta in 2020 was something like $340 billion. This means that the Heritage Savings Fund seems to have tapped out at about 1/17th of the Alberta economy. Compared to Norway’s fund being three times their economy ($1.2 trillion US dollars)—Alberta’s track record (under $20 billion Canadian dollars) seems pretty awful—especially as Alberta’s fund has been around 23 years longer than the Norwegian one).

Another thing to consider.

In 2006 the Albertan government was in one of it’s period oil booms and the Ralph Klein government decided to give away a huge surplus in revenue in the form of a $400 each payment to 3 million Albertans. That’s a $1.2 billion boost to an economy that was already over-heated because of the boom. As a government policy, that’s pretty much insane because in an already hot economy that money would just pump up inflation. It would have been much better to put it into something like the Heritage Savings Fund and used to help out during a downturn—like the next oil bust.

At this point readers would be excused for wondering what this is all leading towards. The point I’m trying to make goes back to one of those quotes that I used to start this article:

many resource-rich economies have weak governance that can be further undermined by the political forces that are unleashed with the prospect of resource wealth.

What I’m trying to say with these examples above is that Alberta is one of those places that has “weak governance” and the province has been “undermined by political forces that are unleashed with the prospect of resource wealth”. What I’m arguing is that Albertan politics is dominated by screwballs because of the resource curse.

The problem is that oil is such a huge part of the Albertan economy that it has far, far, far too much influence on politics. This happens not only because of lobbying and political donations. Too many citizens have extremely well-paid jobs in the oil industry who would probably never be able to as much money doing anything else. This creates a cascading negative political effect on Albertan politics because it makes oil into a ‘third rail’ that no one who wants to get into office can afford to touch.

This is why, for example, only people who deny the existence or implications of the Climate Emergency can get elected. This effectively purges the system of anyone who has a scrap of general intelligence and a personal sense of responsibility towards future generations. In a system like this, is it any wonder that the main choice has to between amoral manipulators (I’m thinking of you Jason Kenney) or just plain whack jobs (yeah, Danielle Smith).

The fact that the Dominion of Canada has at least one province that’s in the grip of the resource curse creates real problems for the rest of the country. (I’m specifically ignoring the issue of other provinces—like Saskatchewan.) Consider—if nothing else—how much the culture of Alberta has come to dominate the Conservative party of Canada. Because of the resource curse’s influence in Alberta—the strongest base of the party—the federal Conservatives have effectively become the Oil Party of Canada. This really screws up our federal political system because what’s good for Imperial Oil is rarely what’s good for Canada.

This also damages other provinces because this pro-oil culture bleeds into the other province’s Conservative parties. That’s why the Ford government in Ontario—which has precious little fossil fuel production—also seems bound and determined to fight against any attempt to prevent runaway climate change. It’s like the ‘general vibe’ of the Oil Party of Canada has stopped a not-particularly smart premier from understanding where the best interests of the place he governs really lie.

At the same time that the base of “oil Tories” in Alberta is twisting politics on the federal level, there’s also a growing separatist movement in Alberta. It’s easy to point out that there’s no way a land-locked Alberta could survive as its own nation, but the fact remains that the Conservatives in Alberta are trying their best to isolate the province from the rest of the country.

If you doubt me, consider the following executive summary of a little book titled FREE ALBERTA STRATEGY:

Alberta’s treatment within Canada has become intolerable. Successive Federal Governments in Ottawa have relentlessly attacked our province’s economic interests, stifled our prosperity, and pillaged the resources and wealth of Alberta’s citizens to purchase electoral support in other parts of the country.

Though Albertans have tolerated the expropriation of our wealth for decades, the federal government has now advanced its anti-Alberta agenda a bridge too far, posing an existential threat to our Province’s economic viability and the core freedoms of our people.

Ottawa has fundamentally breached its constitutional agreement with Alberta. The Alberta government, therefore, has a right and duty to repudiate this arrangement on behalf of its people, to renegotiate its terms of membership in Confederation and, if Canada’s federal and provincial leaders refuse to negotiate, to form an independent nation.

We call upon the Government of Alberta to implement the following package of legislative and other reforms, which we summarize as follows:

1. Passing into law the Alberta Sovereignty Act, granting the Alberta Legislature absolute discretion to refuse any provincial enforcement of federal legislation or judicial decisions that, in its view, interfere with provincial areas of jurisdiction or constitute an attack on the interests of Albertans. This would include Alberta prohibiting any provincial enforcement of the federal carbon tax, the No New Pipelines Act, and attempts by federal agencies to regulate our Province’s energy sector in any manner.

This would necessitate establishing an Alberta Provincial Police Force to replace the Royal Canadian Mounted Police (“RCMP”), and passing into law the Alberta Independent Banking Act designed to expand significantly the number of provincially regulated financial institutions for the purpose of providing Alberta businesses and citizens with protection from enforcement of federal legislation or judicial decisions designated as unenforceable by the Alberta Legislature.

2. Effectively ending federal equalization transfers from Alberta through passing into law the Equalization Termination and Tax Collection Act. In addition to establishing an Alberta Revenue Agency to collect all provincial taxes, this Act would also grant the Provincial Government authority to recover the total amount of equalization confiscated by the Federal Government from Alberta each year, by withholding from the Canada Revenue Agency (“CRA”), an equal amount of federal tax source deductions that are collected by all provincial agencies, municipalities and, at their option, private corporations banking with provincially regulated financial institutions.

3. Opting out of all federal programs that interfere with provincial areas of jurisdiction, including health, education, resource development, environmental regulation, and property rights. This would include replacing the Canada Pension Plan (“CPP”) and Employment Insurance (“EI”) with an Alberta Pension Plan and Alberta Unemployment Insurance designed to deliver to Alberta pensioners and those who become unemployed higher benefits using lower premiums from Alberta workers.

4. Declaring that the Provincial Government will replace the Federal Government as acting authority to negotiate Alberta’s international trade and market access relationships; and further, granting the Provincial Legislature authority to make all future judicial appointments in Alberta through passing into law, the Alberta Judicial Independence Act.

These proposed reforms constitute the key elements of a strategic plan for Alberta to assert its sovereignty, offload the burden of Ottawa’s tyrannical economic policies against the Province, and secure self-determination for the people of Alberta within a reformed confederation, or if necessary, as an independent nation.

We call this proposal, the ‘Free Alberta Strategy’.

For those readers who aren’t keeping up, the Alberta Sovereignty Act in a United Canada was proclaimed on December 12th, 2022. Smith has already suggested publically that she wants to create an alternative Alberta pension fund—but public opinion was so against it that she seems to have temporarily backed down. In addition, in 2020 her party passed a commitment to move away from the Canadian single-payer medical system in favour of a for-profit, private system. (See: UCP approves policy to create private health-care system in Alberta). In addition, premier Smith has also said that she wants to get rid of the RCMP and create her own provincial police force.

I could go on, but I think I’ve established that there seems to be long-term trend at work here—one that is going to create constitutional crisis after constitutional crisis of the sort that dominated relations between Ottawa and Quebec for far, far too long. That too is one of the results of the resource curse: endless conflicts between resource-rich provinces and a central government that has the responsibility of governing a much larger country.

(Oil really is a curse—isn’t it?)