In a recent article I mentioned that changes to the legislation around truth in advertising resulted in cancelling a green-washing campaign by six oil companies. As I also pointed out, however, various governments have already spent almost $6 billion on these ‘fairy tales’.

How come?

Two reasons come to mind.

There’s a narrative being heavily pushed by wealthy/powerful interests to the effect that Canada’s prosperity is dependent on the sale of fossil fuels.

Some significant minorities of the citizenry feel that any threat to fossil fuels is a direct threat to their good-paying jobs.

I thought I’d take a look at these two ideas and see if they pass a ‘smell test’.

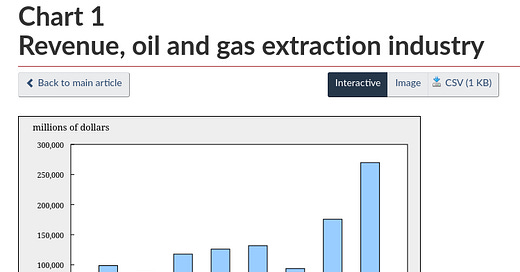

First, here’s a graph from Statistics Canada that shows the amount of money that comes into the economy because of oil and gas.

Take a look at the bar representing 2022. It says that total revenue from the sale of oil and gas was something like $275 billion. As I often say, however, a number without a context is totally worthless. First, let’s divide the revenue from oil and gas by the population of Canada in 2022, which was 38.5 million. The amount per person comes to a little over $7,000 per person. This would suggest that this is very strong incentive to continue with the tar sands.

According to Wikipedia, Canada’s Gross Domestic Product (GDP) for 2022 was $2.8 trillion. This comes to something like $73,000 per person—or one order of magnitude higher. This means that the oil and gas sector in 2022 was an entire 1/10th of the Canadian economy—which is huge! But wait, let’s average the income over the entire eight years on the bar graph and rerun those numbers. If I average all the years from 2015 to 2022, it comes to $142 billion. And if I divide that per person, I get $3,700 each—a significantly smaller number, but still something like 1/20th of the Canadian economy. This raises a significant draw-back to dependence on fossil fuels for our economic prosperity—it makes us dependent on the sort of boom/bust cycle that has plagued Alberta for my entire lifetime. Is this something our entire nation wants to build it’s economy around?

Let’s look at that second issue. Does oil give the people of Alberta a greater standard of living than anywhere else in Canada? It appears that this is true. Consider the following table from Wikipedia.

According to this table, in 2022 Alberta had over 16% of the Canada GDP while having less than 12% of the population. This translated into $102,000/person. In contrast Ontario had 37% of the GDP, with a little under 38% of the population. This worked out to $69,000 GDP per person. (Remember, as per my calculations above, that 2022 was a ‘boom’ year—things would have been different in a ‘bust’ one.)

Let’s back off a bit and look at some other issues, however. One of the complaints that some economists have had with traditional GDP numbers is that it just adds, but doesn’t subtract. That’s to say, every economic activity gets added to it—whether it is is good for the community or not. For example, forest fires are good for the GDP in a given community insofar it means that fire-fighters get money and so do contractors who have to rebuild burnt-out properties. It might be the case that next year the GDP will go down because various people left town and some businesses never rebuilt—but that’s next year.

But citizens don’t live in the cloud-cuckoo land of economists, which means that a forest fire is a bad thing because it is destructive. And in a similar way, the oil sector has costs that should be subtracted from the economic activity that has been counted above.

One of these is the cost of cleaning up oil wells and infrastructure. This isn’t a cost that’s going to be easy to calculate because it’s based on a lot of factors that will only be obvious once the job is done. These issues include:

how much money there will be for oil companies to pay for the clean up—which is tied to how much oil they are able to sell, and, this dramatically influences the second point

how many of the wells are owned by bankrupt or extremely close to bankrupt companies who simply cannot pay for clean up

how much cleanup will actually cost—like any engineering project, cost estimates are literally not much more than informed guesses, which why so many projects of all sorts end up cost much, much more than the citizenry were originally told they would cost (again, more about this later)

In one CBC article I found, the Parliamentary Budget Officer came up with the number of $1 billion to clean up 10,000 orphan wells—but freely admits that the actual cost will be much more:

Oilsands, cleanup of pipelines not included in report

The cost doesn't include cleanup of pipelines or other energy infrastructure on the land. It doesn't include oilsands.

It does not include 7,400 wells that are considered abandoned but not yet orphaned. If those wells were included, the report says current liability would more than double to $801 million.

It doesn't include liability from the 225,000 wells in Alberta and Saskatchewan that are considered inactive or plugged. Nearly two-thirds of all wells in those provinces no longer pump, the highest percentage ever, and most wells declared inactive never start again.

Nor does it include the full cost of cleanup.

The report only considers the cost of tidying up the land surface and removing equipment. It doesn't consider the costs of remediating ongoing contamination from underground chemicals or leakage.

"The exclusion of remediation will understate the total cost of well cleanup," the report says.

There isn't enough data on the highly variable costs of such cleanups to make a meaningful estimate, said Giroux.

"The data is very limited on this. The reclamation costs can vary greatly from one well to another."

In another CBC article, the reporter quotes a former engineer in the oil industry, Gillian McKercher. She created a documentary film on the subject who thinks the cost of clean-up is going to be astronomically higher.

"In Canada alone, there are at least 475,000 conventional oil and gas sites that need to be cleaned up, at an estimated cost of $40-billion to $76-billion," Gillian said.

"This is a non-partisan issue. Many companies can't afford to take care of their liabilities; they will go bankrupt. So where is the money and the labour going to come from? How can the public keep the oil industry accountable to clean up. What about orphaned wells? Wells that no longer have an owner because its company went bankrupt. Who will clean them?"

I’m not suggesting that I know how much cleaning up the oil industry infrastructure in Alberta and Saskatchewan will be. In fact, I suspect no one really knows. But it’s not going to be small—and I doubt very much that any of the numbers that the oil industry and their political supporters are throwing around to convince Canadians to continue to support the oil industry are taking these costs into account.

There’s another element to consider. Think about the Trans Mountain pipeline that the government built because the private sector bailed. Here’s a clip from a video by the CBC to introduce the issue.

I included that last bit where Ryan Bushell added the standard oil-industry spin to the effect of “those damn Liberals, they let the project get out of control!”. The story goes on to imply that the reason why the project cost so much was because of a small number of environmental kooks forcing the pipeline people to move bird nests and ant hills. My inclination is to just dismiss this as ‘spin’ and suggest that a more objective analysis would suggest that Covid, mass opposition by First Nations and environmentalists, and, the general inability of engineers to do much more than ‘guesstimate’ the cost of giant projects is probably more at play.

I also wonder if Kinder Morgan (the original company that proposed the pipeline) was publicly being a little ‘optimistic’ about the ultimate cost of the project while at the same time realizing that it would probably cost a lot more—which is why they backed out. I also suspect that some pro-oil industry reps may have also suspected this, but if the federal government could be bullied into building the pipeline that they would end up having to run or sell at a considerable loss—it would be a nice hidden subsidy to their industry. (Corporate welfare bums, anyone?)

If you are still upset about the cost of the pipeline (I know I am), it might help to learn something about giant project cost over-runs that the overwhelming majority of the public don’t understand. That number that politicians and reporters repeat in stories like the one above—it’s fundamentally a guess about a moving target. Here’s an excerpt from a YouTube video that I think everyone should see in full: Why Construction Projects Always Go Over Budget. It explains why.

So what am I trying to say?

Mainly, that while it looks like oil is good for the economy of Canada—and especially Alberta—we need to be skeptical about these claims. That’s because:

claims that it can become ‘carbon neutral’ seem to be an out-and-out fraud (as explained in my article about changes to the truth in advertising legislation)

there are significant costs associated with the oil industry—like pipelines, "fairy tale” projects like carbon capture, and, cleaning up orphan oil infrastructure

reliance on oil ties Canada to a boom and bust economic cycle that creates damaging financial uncertainty for both individuals and governments

Substack is warning me that this article is getting a bit long, so I’m going end here and discuss some more stuff in a future article.